You are in good company

Work with some of the best talent in the industry

Be part of a fast paced work environment packed with learning

Freedom and opportunity to grow and become a future leader

You are in good company

Work with some of the best talent in the industry

Be part of a fast paced work environment packed with learning

Freedom and opportunity to grow and become a future leader

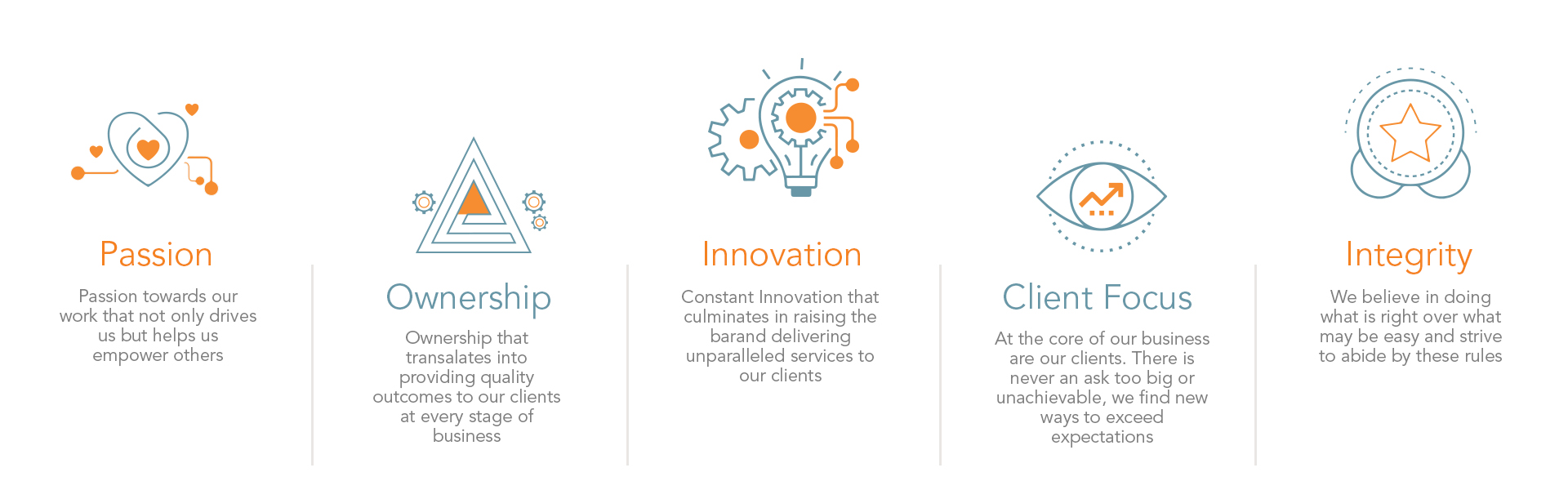

Our values

Work with us

Drop us an email at jobs@incred.com with your CV and a short introduction,

explaining why you think you’re a right fit for us.

Do mention the function that you would be interested in applying for.

Work with Us

Drop us an email at jobs@incred.com with your CV and a short introduction,

explaining why you think you’re a right fit for us.

Do mention the function that you would be interested in applying for.